Thinking about selling your Ripple (XRP)? This guide provides a clear, step-by-step process for selling your XRP safely and efficiently in 2025. We'll cover the best methods, associated fees, and crucial risk mitigation strategies. Whether you're a seasoned crypto trader or a newcomer, this guide will empower you to make informed decisions.

Choosing Your Selling Strategy: Exchanges vs. Peer-to-Peer (P2P)

Your primary choices for selling XRP are established cryptocurrency exchanges and peer-to-peer (P2P) marketplaces. Each approach presents distinct advantages and disadvantages.

Cryptocurrency Exchanges (e.g., Coinbase, Binance, Kraken):

Advantages: Exchanges generally offer higher security, greater liquidity (faster sales with less price impact), and streamlined processes. They typically provide various payment options.

Disadvantages: Know Your Customer (KYC) verification is usually required, potentially delaying the sale. Exchanges charge fees, varying widely depending on the platform and payment method. Are exchange fees always worth it given the security and speed?

Peer-to-Peer (P2P) Marketplaces:

Advantages: P2P platforms may sometimes offer slightly better prices due to less regulatory oversight. They might also provide more diverse payment choices and potentially lower KYC requirements.

Disadvantages: P2P platforms carry significantly higher risks, including a greater likelihood of scams. Transaction speeds and reliability are typically less consistent compared to exchanges. Thorough due diligence is crucial to mitigate these higher risks.

Head-to-Head Comparison:

| Feature | Cryptocurrency Exchanges | Peer-to-Peer (P2P) Marketplaces |

|---|---|---|

| Security | High | Low |

| Transaction Speed | Fast | Slow |

| Fees | Moderate, platform-dependent | Variable, potentially higher, less transparent |

| Ease of Use | User-friendly | More complex, potentially risky |

| Regulatory Oversight | High | Low, increased risk of scams and fraud |

The optimal choice depends on your priorities. Prioritizing speed, security, and ease of use points towards reputable exchanges. If a potentially better price and reduced personal information sharing are paramount, carefully consider a P2P platform, acknowledging the increased risk.

Selling Your XRP on an Exchange: A Step-by-Step Guide

Selling XRP through a reputable exchange offers a generally safer and more efficient process. Follow these steps:

Account Creation and Verification: Create an account on your chosen exchange and complete the KYC verification process. This is crucial for compliance and security, but be aware that it may take time.

Transferring Your XRP: Transfer your XRP from your personal wallet to your exchange wallet. Double-check the recipient address to prevent irreversible loss of funds. Note that network fees (small transaction fees) apply to this transfer.

Placing a Sell Order: Choose your trading pair (e.g., XRP/USD). Specify the amount of XRP and your desired price (limit order) or sell at the current market price (market order). Limit orders guarantee you sell at your specified price or better; Market orders sell instantly but at the current (potentially fluctuating) market price.

Confirmation and Completion: Carefully review all details, including fees, before confirming your sell order. Once confirmed, your order will process.

Withdrawing Your Funds: Withdraw your funds (in your chosen fiat currency) to your bank account or other designated account. Be aware of platform-specific withdrawal limitations and fees.

Navigating Fees and Risks: A Realistic Perspective

Exchanges and P2P marketplaces charge fees. These fees, which can vary considerably, must be factored into profit calculations. Common fee types include percentage-based trading fees, flat fees, withdrawal fees, and XRP Ledger network fees. Always research fee structures before selling.

Security is paramount. Never share your private keys or seed phrases with anyone.

Staying Ahead of the Curve: XRP Market Dynamics

The cryptocurrency market is volatile. Regulatory changes, market sentiment, and global economic conditions can all significantly impact XRP's price. Staying informed through reputable sources is vital for timing your sale effectively.

Disclaimer: This guide is for informational purposes only and not financial advice. Consult a qualified financial advisor before making any investment decisions. Investing in crypto carries significant risk of partial or total loss.

Minimizing Fees When Selling XRP on Different Exchanges

Different platforms offer varying fee structures. Let's explore strategies to minimize fees:

Choosing Your XRP Selling Platform:

Cryptocurrency Exchanges: High liquidity, but fees vary significantly (trading fees, withdrawal fees). Compare fees across exchanges (Binance, Kraken, etc.) before choosing.

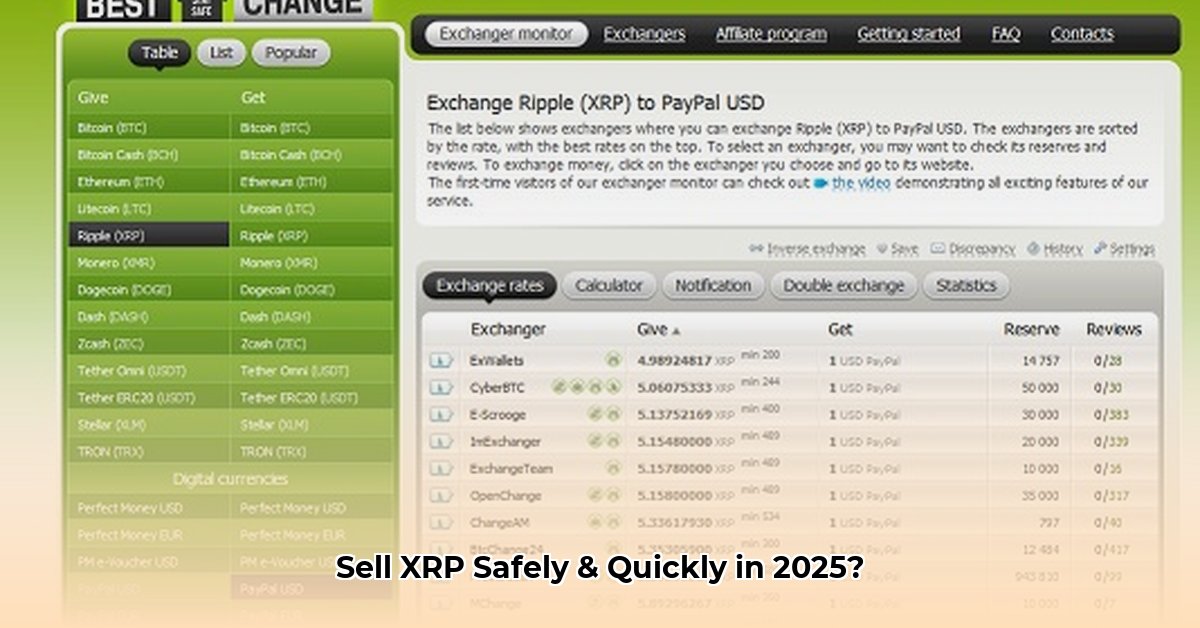

Peer-to-Peer (P2P) Markets: Potentially better prices, but higher risk. Fees are variable and may be less transparent.

Crypto ATMs: Convenient but typically have the highest fees.

Understanding XRP Fees:

Network Fees: Inherent to XRP Ledger transactions. Usually small, but vary based on network congestion.

Platform Fees: Charged by the exchange, P2P platform, or ATM. These vary widely.

Minimizing Your XRP Sale Fees:

Compare Exchange Fees: Thoroughly compare fees across platforms before selling.

Time Your Sale: Market volatility influences prices and potentially fees. Consider timing your sale strategically, taking into account market fluctuations.

Efficient Withdrawal Methods: Select withdrawal methods with minimal fees (bank transfers, for example, may take longer than credit card withdrawals).

Maximize Transaction Size: Larger transactions might sometimes reduce per-unit fees.

Loyalty Programs: Some exchanges offer fee reductions for frequent users.

Prioritize security over marginal fee savings. Always thoroughly research each platform before use. https://www.kraken.com/learn/sell-xrp-xrp